As a single stick pattern, shooting stars don’t necessarily give any direct indication of where to place your stop loss and take profit. Another similar candlestick pattern in look and interpretation to the Shooting Star pattern is the Gravestone Doji. The long upper shadow of the Shooting Star implies that the market tested to find where resistance and supply was located. Now that we have the shooting star confirmation criteria behind us, we will combine these three basic steps into a trading strategy. Once you are able to identify the shooting star, you should look to open a short position on a break of the low of the candle. However, this also looks like an inverted hammer candle pattern.

- The Shooting Star pattern is considered a bearish candlestick pattern as it occurs at the top of an uptrend and is typically followed by the price retreating lower.

- Any action taken by the reader based on this information is strictly at their own risk.

- If a stock is in a bullish uptrend and you identify a shooting star candle, then there is a solid chance that the trend will reverse.

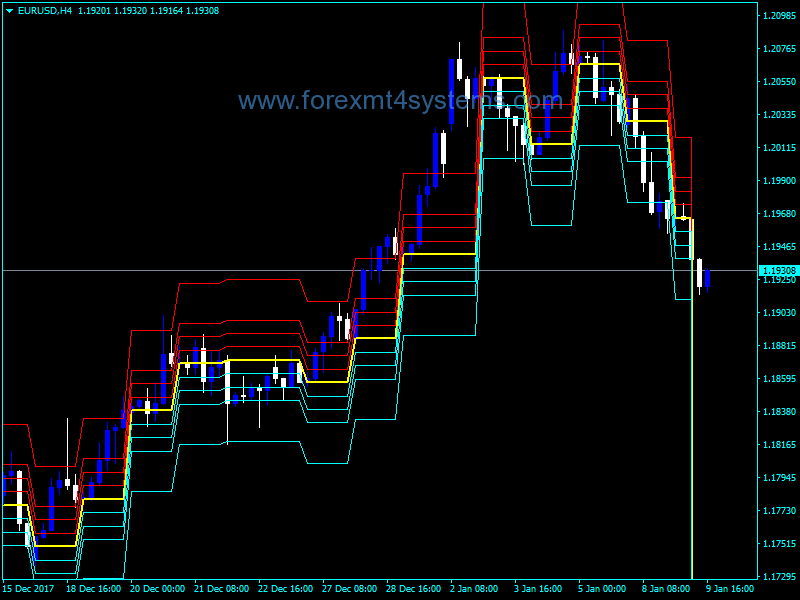

The shooting star pattern consists of two candlesticks with a small gap between them. The pattern signals the increased influence of the bears and the imminent reversal at the top. On top, this pattern is quite reliable with the support of other reversal patterns. However, a shooting star can give false signals in an uptrend at higher volumes. After technical analysis and opening a short trade, it is important to set a Stop-loss. According to risk management rules, stop-loss (red dotted line) must be set above the broken out support level or 500 basis points above the position opening.

Try a Demo Account

Candlestick charts are used by traders to determine possible price action based on past patterns. Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. Inverted Hammer is a bullish candlesticks chart formation at the bottom of downtrends. However, this same form found at the top of uptrends is called shooting star. The shooting star is a type of candlestick pattern and refers to the candle’s shape and appearance, representing a potential reversal in an uptrend. Both the hammer and inverted hammer candlesticks are taken as indications by traders that a bullish reversal might be coming.

Only after getting the confirmation, you can decide on the entry point of your trade. The shooting star candle and the inverted hammer share a significant attribute. However, they differ depending on when they occur and the trading signal they imply. The shooting star pattern can occur when trading any security from forex to commodities and even stocks. It is not limited to a particular instrument as it is a function of trader’s sentiments and price action.

The inverted hammer candlestick is useful for beginners and advanced traders alike

A hanging man is a bearish reversal pattern that can signal the end of a bull run. A Japanese rice trader called Munehisa Homma developed the idea of candlestick charts in the 18th century. Today, crypto traders use candlestick charts in their technical analysis to forecast what might happen next regarding asset prices. The inverted hammer candlestick (also called an inverse hammer) signals the end of a downtrend.

Technical Classroom: Here’s what you need to know about Shooting … – Moneycontrol

Technical Classroom: Here’s what you need to know about Shooting ….

Posted: Sun, 30 Sep 2018 07:00:00 GMT [source]

You cannot enter any trade without making an exit plan, as it may lead to unlimited losses. It is important that you consider your risk appetite and determine an appropriate stop-loss based on them. As a part of our market risk management, we may take the opposite side of your trade.

Take profit

When bullish traders acquire confidence, an inverted hammer candlestick appears. Bulls attempt to drive the price as high as they can, while bears (or short-sellers) attempt to fight the higher price. The positive tendency, however, is too powerful, and the market ends up at a higher price. For example, you can have a hammer candlestick pattern at the top of an uptrend which will also signal a reversal.

However, the buyers lose control over the price action, which initiates the pullback. A failure at important resistance/support levels is not a normal failure, it is usually much more important. For this reason, the price action rotates back lower following a failure to clear the resistance and returns to support. Thus, although the buyers were successful in pushing for a new high, they failed to force a close near the session’s high. Their inability is now a chance for the sellers to reverse the price action and erase previous gains.

If the successive candlestick is red, it acts as a confirmation of bearish reversal. You should always try to put stop-loss targets above or higher than the candle’s high. To see why it’s seen as a bullish reversal pattern, we can take a closer look at the potential price action within the session. Based on the analysis of over 4,000 markets, PatternsWizard has concluded the inverted hammer confirms a bullish reversal 36.5% of the time on average. This is a great option for beginner technical traders, as it helps you plan your strategy without putting up any capital.

Shooting star candlestick pattern: a technical analysis guide

Despite looking exactly like a hammer, the hanging man signals the exact opposite price action. A green inverted hammer is considered a more bullish indicator than its red counterpart, although both are considered bullish. In both instances, the closing and opening prices will be very close together, helping to create the hammer shape of the candlestick. Stop orders for the sell stock indices trades should be placed a few pips above the highest stock indices price on the recent high. Alternatively, a shooting star appearing at a known level of resistance will also add to the strength of the signal. If you’re using Fibonacci retracements, for example, then a shooting star appearing at a key retracement level can be a good sign to trade.

The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. Consequently, the open and close price points are close to one another. The long upper shadow is usually twice the length of the candlestick’s real body. As with the hammer, you can find an inverted hammer in an uptrend too. But here, it’s called a shooting star and signals an impending bearish reversal. You can learn more about how shooting stars work in our guide to candlestick patterns.

Hammer Candlestick: What It Is and How Investors Use It – Investopedia

Hammer Candlestick: What It Is and How Investors Use It.

Posted: Sun, 26 Mar 2017 17:15:36 GMT [source]

Fortunately, the next candle is bearish and breaks the low of our shooting star candle on the chart. This gives us a strong bearish signal and we short Apple at the end of the bearish candle. At the same time, we place a stop loss order at the highest point of the shooting star – above the upper candlewick.

Additionally, the stretch between the opening price and the day’s highest price has to be at least twice as big as the body of the shooting star. The Hanging Man is a bearish reversal pattern that can also mark a top or strong resistance level. The chart below shows that a strong bullish rally has begun. The first shooting star pattern was formed, then the price bounced off the lower border of the ascending channel with an impulse green candle. This candlestick pattern can prove to be hugely beneficial for traders as it predicts arrival of an imminent downtrend. However, sellers or bears take control and towards the end of the day, the price slides close to the opening level.

The candles would be red or black which gives credence to their bearish nature. The shooting star pattern can occur during periods when bulls appear to be in total control, with prices likely to continue edging higher. When the shooting star occurs, it first rises, implying the buying pressure experienced during the previous session is still in play. However, as the session or day progresses, short sellers enter the fray piling the pressure on the bulls. This move would form a classic hammer pattern on a chart, and technical traders would then expect eurodollar to enter a new uptrend.

An Inverted Hammer pattern forms when the buyers push the stock price higher against the sellers. The pattern reflects buying interest for technical, psychological, or fundamental reasons. When the pattern forms in a downtrend, it suggests a possible market bottom or change in trend. The basic structure of a shooting star candlestick remains the same – a small real body with a long upper wick and no lower wick. All these serve as visual indicators and help you in identifying this pattern.

The Shooting Star candlestick pattern forms when buyers push the price higher against the sellers. The pattern reflects selling interest for psychological or fundamental reasons. shooting star vs inverted hammer When the pattern forms in an uptrend, it suggests a possible market top or change in trend. The uptrend accelerates just prior to the formation of a shooting star.

Leave a Reply